Update (4/30/13): The FCC has given its approval for the ABRY purchase of Securus Technologies from Castle Harlan. From the Public Notice:

Update (4/30/13): The FCC has given its approval for the ABRY purchase of Securus Technologies from Castle Harlan. From the Public Notice:

“Upon review of the record, we find that the transaction is likely to result in certain public interest benefits, including increased capital resources available to Applicants to make service improvements.

In addition, Applicants affirm that they will continue to be bound by existing contract rates for service to customers and that there will be no changes in rates, terms, or conditions of service as a result of the transaction.

Nonetheless, this grant does not approve the current rates, terms, or conditions, and as noted above, the Commission is reviewing those issues in the Inmate Calling NPRM

proceeding.

Accordingly, and subject to the condition stated above, we find that grant of the Applications will serve the public interest, convenience, and necessity.

Pursuant to sections 4(i) and 214 of the Communications Act of 1934, as amended,and sections 0.291 and 0.261 of the Commission’s rules,WCB and IB, under delegated authority, approve the Applications listed herein subject to the condition stated above.”

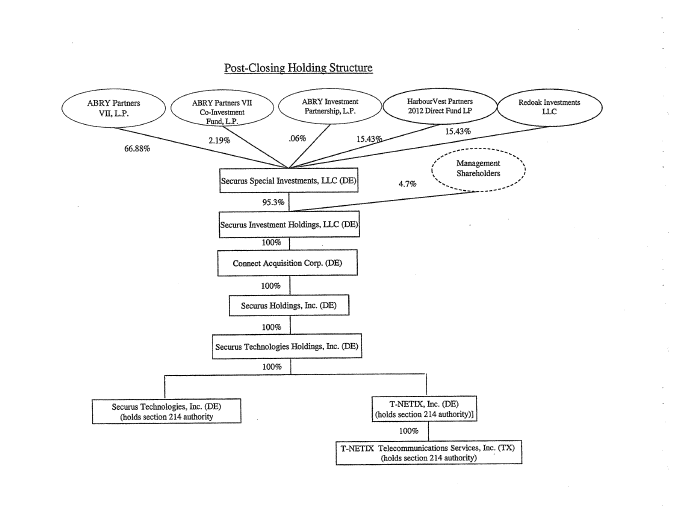

Update (4/21/13): Some additional deal details – Abry Partners is acquiring a 66.9% stake in prison phone operator Securus Holdings Inc. from Castle Harlan in a transaction not officially announced by the buyer, but revealed in regulatory filings. The deal could value the target at more than $700 million.

Also taking additional minority stakes in Securus are HarbourVest Partners, Redoak Investments LLC and Mesirow Financial Capital Partners, according to a document from the Arizona Corporation Commission, which oversees licensing for telecommunications in the state.

Dallas-based Securus Holdings, through its operating company, Securus Technologies Inc., is a specialized telecommunications company operating secure telephone and communication services for prisoners in the U.S. and Canada.

To finance the acquisition, Securus is arranging $540 million in debt, which, according to Moody’s Investors Service, includes a $50 million senior secured five-year revolver, a $335 million senior secured seven-year first-lien term loan and a $155 million eight-year senior secured second-lien loan.

This amount of debt is 1.5 times more than the debt raised when Castle Harlan acquired the company from H.I.G. Capital in 2011. While sources estimated that Castle Harlan paid more than $500 million for Securus in 2011, Abry Partners’ acquisition could value the company at north of $700 million, based on comparable deals.

For instance, EarthLink Inc.’s acquisition of ITC^DeltaCom Inc. in October 2011 was valued at $516 million, 1.6 times the $325 million in debt used to finance the deal.

The next month, American Securities LLC acquired Global Tel*Link Corp., also a provider of telecom services to prisons, in a deal valued at $1 billion, or about 1.5 times the $655 million in debt used to finance the deal, based on data from Moody’s.

Similarly, in December 2011, payment communications company TNS Inc. was taken private by a consortium led by Siris Capital Group LLC in a deal valued at $862 million, 1.3 times the $690 million in debt raised to finance the acquisition, according to data from Macquarie Group Ltd.

According to the document from the Arizona Corporation Commission regarding the sale of Securus to Abry Partners, Moody’s assigned a B2 rating to the revolver and first-lien debt and a Caa2 rating to the second lien loan on Tuesday.

Deutsche Bank AG and BNP Paribas SA will hold a lender call on Thursday morning to launch the $540 million, first- and second-lien financing, Standard & Poor’s Leveraged Commentary and Data reported.

Moody’s also assigned a B3 corporate family rating with stable outlook to the company, citing its “sophisticated, proprietary technology platform and its multiyear contracts with over 2,200 correctional facilities in the U.S. and Canada” and “by improvements in operating margin and cash flow which have been achieved through cost containment and lower bad debt expense.”

Moody’s estimates Securus’ leverage will be 6.6 times following the transaction and that the company’s leverage will remain above 5 times through 2015.

The ratings agency said it could upgrade the ratings if Securus maintains good liquidity and positive free cash flow and grows Ebitda such that leverage is on track to fall below 5 times.

Castle Harlan acquired Securus from H.I.G. Capital in April 2011. Terms of the transaction were not disclosed, but BNP Paribas and GE Capital Markets Inc. arranged a $365 million senior secured loan that the private equity firm used to purchase Securus.

In May 2012, Securus paid a $76.5 million dividend to Castle Harlan and other shareholders, according to S&P.

Miami firm H.I.G. formed Securus in 2004 when it acquired Evercom Systems Inc. and merged it with T-Netix Inc., which H.I.G. took private in the same year for about $70 million, according to regulatory filings.

(Source)

Update (4/17/13): Public Knowledge, The United Church of Christ Office of Communication, Inc., Free Press, and the Rainbow/PUSH Coalition filed with the FCC to block the purchase of the telephone company Securus by the Hedge Fund ABRY Partners:

“Under the law, no one is entitled to buy a telephone provider unless the FCC finds the transaction will serve ‘the public convenience and necessity.’ The organizations filing the Petition to Deny argue that because the rate charged by Securus are ‘unjust and unreasonable,’ the FCC must block the sale.” (Source)

Update (4/5/13): Buyout firm Castle Harlan Inc. is in talks to sell Securus Technologies Inc., The provider of video and audio communication equipment for U.S. prisons, for about $640 million, said people familiar with the matter.

Castle Harlan is negotiating to sell the company to private-equity firm ABRY Partners LLC, said the people, who asked not to be named because the process is private. Boston- based ABRY, which manages $3.5 billion, is seeking to raise $490 million to help finance the purchase and pay down existing debt, said one of the people.

After the acquisition, Securus’s total debt would be about 5.8 times its earnings before interest, taxes, depreciation and amortization, said one of the people.

New York-based Castle Harlan bought Securus in 2011 for about $440 million, that person said.

(Source)

Original Post:

From recent filings at the FCC and with state regulators, it appears that Castle Harlan has sold Securus Technologies to Abry Partners.

The timing is interesting given that comments were due Monday to the FCC on the Proposed Rule Making finally taking up the Wright Amendment to reduce the cost of interstate inter-exchange inmate calling services (ICS). If such a ruling is adopted, it could potentially reduce the revenues and profitability of ICS providers such as Securus.

- Blockchain System for Compliant Inmate Transactions - March 4, 2025

- Securus Gets the Signal, Eleven Years Later - August 23, 2024

- Multi-Blockchain System for Inmate Forensics - April 2, 2024